We’ve got more 5 Star reviews on Trustpilot than any other travel insurance provider

What is annual multi-trip travel insurance?

If you’re going on more than one holiday a year, annual multi-trip travel insurance could be just what you need.

One policy saves you the hassle of setting up new travel insurance every time you go abroad. Annual travel insurance can often work out better value if you’re going on more than one trip in a year.

Your annual travel insurance covers you for up to 183 days of travel in 12 months. That’s plenty of time to put your feet up and relax.

Plus, if your annual travel policy comes to £80 or more, you can pay in monthly instalments to spread the cost. It’s easy to set up online or over the phone.✝

What does annual travel insurance cover?

Take out your policy as soon as you’ve booked your first holiday and you’ll be covered for:

✔ Cancellations and cutting your trip short

✔ 28 days of winter sports cover when you take out a Signature policy

✔ Travel disruptions and delays

✔ Lost or stolen cash

✔ Lost or damaged baggage

There’s no upper age limit, and we can cover most pre-existing conditions. You just need to let us know about them when you take out your policy.

| Basic | |

|---|---|

| Medical emergencies and repatriation | Up to £5m |

| Cancellation | Up to £500 |

| Cutting your holiday short | Up to £500 |

| Baggage | Up to £300 |

| Travel delay | Up to £300 |

| Money and passport | Up to £300 |

| COVID-19 | |

| Excess | £129 |

| Comprehensive | |

|---|---|

| Medical emergencies and repatriation | Unlimited |

| Cancellation | Up to £5k |

| Cutting your holiday short | Up to £5k |

| Baggage | Up to £2.5k |

| Travel delay | Up to £1.5k |

| Money and passport | Up to £500 |

| COVID-19 | |

| Excess | £99 |

| Signature | |

|---|---|

| Medical emergencies and repatriation | Unlimited |

| Cancellation | Up to £10k |

| Cutting your holiday short | Up to £10k |

| Baggage | Up to £5k |

| Travel delay | Up to £1.5k |

| Money and passport | Up to £500 |

| COVID-19 | |

| Excess | £0 |

| Basic | Comprehensive | Signature | |

|---|---|---|---|

| Medical emergencies and repatriation | Up to £5m | Unlimited | Unlimited |

| Cancellation | Up to £500 | Up to £5k | Up to £10k |

| Cutting your holiday short | Up to £500 | Up to £5k | Up to £10k |

| Baggage | Up to £300 | Up to £2.5k | Up to £5k |

| Travel delay | Up to £300 | Up to £1.5k | Up to £1.5k |

| Money and passport | Up to £300 | Up to £500 | Up to £500 |

| COVID-19 | |||

| Excess | £129 | £99 | £0 |

These are just a few of the things our policy covers. For the ins and the outs, take a look at our policy wording.

Get QuoteWhat’s not covered?

Your multi trip holiday insurance policy is there to protect you if things don’t go to plan. But not everything will be covered.

It’s always important to read your policy documents before you go on holiday. This way you can understand what you will and won’t be covered for.

Discover what you need to know before/buying travel insurance in our guide.

Your Staysure policy won’t cover these types of claims:

Whether you’re sailing the seven seas on an ocean cruise, or you’d rather not pay any excess, tailor your policy with extra cover. All add-ons are available on annual policies.

Hit the road and explore to your heart’s content! Be confident that any accidents or damage to your hire car can be covered up to £4,000. It can be added to any policy.

Lucky enough to be travelling for more than 50 days? If you’re 70 or under, you can upgrade your policy cover before you travel, for up to 100 consecutive days of travelling in one trip. It’s available on Comprehensive and Signature policies only.

Off on a cruise holiday? Cruise Plus Cover protects you against things like not being able to dock at a scheduled port due to bad weather, and cabin confinement. It’s available on Comprehensive and Signature policies. Find out more about our different levels of Cruise cover.

If you’re going to be taking expensive tech away with you, like a laptop, smartwatch or smartphone, Gadget Cover can protect an unlimited number of your devices for up to £2,000. This cover includes protection against accidental loss or theft, damage from accidents or malicious intent, liquid damage, and unauthorised call, text or data usage. It’s available on Comprehensive policies as an add-on, but included on Signature policies as standard. Learn more about Gadget Cover.

Cover for cancelling or cutting your holiday short if the FCDO (Foreign, Commonwealth & Development Office) advises against all, or all but essential travel to your destination because of an unforeseen incident such as an earthquake, fire, flood or hurricane. Find out more about our Travel Disruption cover. It can be added to any policy.

Golf insurance covers your golf equipment hire and non-refundable golfing fees. You’ll have hole-in-one cover too – meaning we’ll pay you £300 if you score a hole-in-one during your trip, as long as you’re a member of a recognised golf club affiliated to a national golfing union, you have your scorecard signed by your playing partner and you’re playing at a golf affiliated golf course too. It’s available on Comprehensive and Signature policies when playing non-professionally only.

How much does annual travel insurance cost?

Annual travel policies are usually more expensive than single trip policies. But if you’re going on more than one trip in a year, they normally work out better value for money.

There are five different regions you can choose to cover when you take out an annual travel policy, which will also affect the price. Make sure you choose the right region to cover all your holiday destinations.

You can read more about what affects the price of travel insurance in our guide.

What can affect the cost of your annual policy?

What our expert says…

“With so many policies available it can be difficult to decide which type of travel insurance is best for you. Annual travel insurance is great if you’re planning multiple trips throughout the year, but if you don’t travel often, a single trip policy can give you more flexibility.”

- Ria Wong - travel insurance expert

Read Ria's guide to the difference between annual and single trip policies

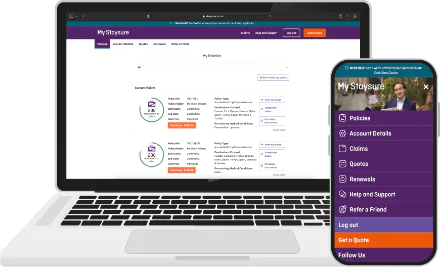

Already a customer? You can make changes to your policy, online and in your own time with My Staysure.

We know you don’t want to wait in a call queue. So if you need to make changes, like updating traveller details, changing your medical details or renewing a policy, visit your My Staysure account.

You can travel as many times as you want for a total of 183 days in the 12 months of your policy.

There are a couple of things to know about how long you can spend abroad in one go:

Planning a longer trip? Long stay travel insurance could cover you for up to 18 months, depending on your age.

Wherever you want if you choose the right region when you take out your policy. You have five options:

You need to tell us about your pre-existing medical conditions when you take out your policy. This includes high blood pressure, diabetes, and cancer. This means you’ll be covered if you have a medical emergency relating to that condition.

Adding cover for your conditions is simple. You can do it online or by calling our contact centres. If anything changes between taking out your policy and going on holiday, you need to let us know, but you can also do this online.

You still need travel insurance even if you have a GHIC or a valid EHIC.

A GHIC/EHIC is not a replacement for holiday insurance. These cards won’t cover you for cancellations, loss of baggage, repatriation and other things that a travel insurance policy can.

But you should still carry a GHIC/EHIC when you go abroad. In fact, it’s a condition of our policies that you do. These cards mean you can get emergency, state provided healthcare in EU countries for free, or at reduced cost.

If you use your GHIC/EHIC when travelling and need to claim, we’ll waive the excess that you’d normally have to pay on medical claims.

Find out more, and how to apply, in our guide to GHIC.

You should buy your annual travel insurance policy as soon as you’ve booked your first holiday. That way you’ll be covered for any cancellations for any trips you have planned.

A specialist travel insurance provider can give you support, advice and peace of mind if the unexpected happens before or during your trip.

Some people rely on bank travel insurance, but did you know that you’re 9% more likely to have a claim rejected by a bank?

Choose a specialist travel insurance provider to build a tailored policy that suits you:

We understand how important it is for your travel insurance to offer the right level of cover so you can travel with confidence. We cover most pre-existing conditions, but occasionally, we might not be able to help.

If that’s the case, we recommend checking out BIBA’s medical directory or calling them on 0370 950 1790. They can provide a full list of specialist medical travel insurance providers who might be able to help.

We're here to make your claim journey as stress-free as possible

*Available on Signature policies only.

✝Available on Annual Multi-trip policies to the value of £80 and over. Howserv Ltd use Premium Credit Ltd ((PCL) an external credit provider) to provide finance. Howserv is a credit broker not a lender and receive a commission for introducing customers to PCL. On acceptance, a credit agreement will be set up. Representative example based on a £200 policy (net of the paid deposit of £18.61). An Annual Percentage Rate of 24.9% will be charged with a fixed interest rate of 12.55%. Amount of interest over 11 months= £22.77. Monthly repayments of £18.56. Total amount payable £222.77. Correct at time of print.